Universities, corporations, SMBs, the public sector, and startups all drive innovation, so why focus on stocking the innovation funnel with high growth startups? First, startups catalyze building the connective tissue of an ecosystem more efficiently than any other type organization. Startups are the hungriest, fastest moving players in any innovation ecosystem. They are magnets for capital, talent and attention. The knock-on impact of startup activity is tighter connections between the anchors (major universities, corporations, investors) of an innovation ecosystem. Second, startups attract angels and venture capitalists, who are also among the strongest networked players in any innovation ecosystem. Startups and their venture capital investors, together, nucleate innovation ecosystems.

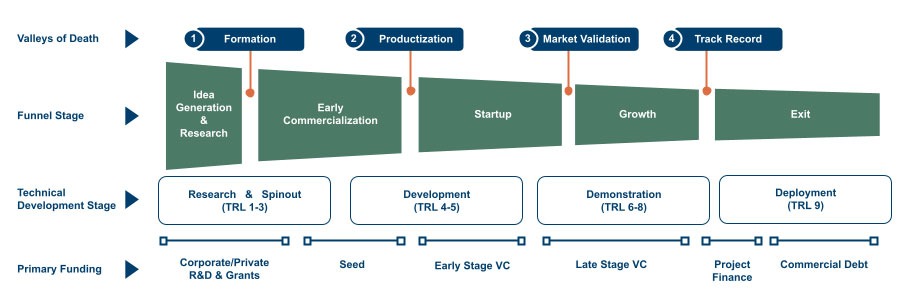

Startups, especially those in cleantech, traverse multiple stages of growth and numerous “valleys of death” that create fallout along the path (Figure 1). CCOs, CMOs and SVPs of Sales all use funnels to evaluate the health of their customer/deal pipelines, innovation ecosystems should take the same approach. The innovation funnel view allows for the identification of an ecosystems shortcomings. For example, an unexpectedly high fallout rate between Idea Generation & Research and Early Commercialization may signal an issue in company formation. Root cause analysis and targeted programs, perhaps Entrepreneur-in-Residence programs at universities or a program like the Activate Fellowship, can address this specific issue. Additionally, thin stages in a funnel can be filled by different means.

Young ecosystems often have an overrepresentation of organically-grown early stage companies in their innovation funnels. These ecosystems can simply wait for companies to mature to create a healthy funnel, or they can supplement organic development by actively recruiting later stage companies to relocate to their ecosystem. Stocking an innovation pipeline requires a funnel view.

Figure 1: Cleantech startup development pathway: Valleys, Funnel, Development and Funding

So, building an innovation ecosystem quickly requires stocking the innovation funnel with high growth startups, where is Georgia’s ecosystem today?

What Does Good Look Like?

A strong, mature innovation ecosystem should have quality companies across the every stage of the innovation funnel. That is not insightful nor is it controversial, but why is it important? Ecosystems with well-balanced innovation funnels typically have the specific types of capital (Figure 1) and supporting programs that startups at each phase of their development need. Ecosystems focus a lot on attracting capital and programs, and rightly so. However, one important feature of strong innovation funnels that are often overlooked are the deep pools of experienced startup talent they develop. Startups, especially cleantech startups, need people with very unique types of experience, like:

- sales executives that have sold new product categories into highly regulated markets, or

- operations leaders that know how to transfer manufacturing from early inhouse builds to a CMO or

- CEOs that know how to work with professors and universities to spinout a startup.

Established, balanced ecosystems have these people, while nascent, developing ecosystems typically do not and startups can suffer because of it. More will be written on this topic in a future post.

That brings up one more relevant point, “good” depends on the maturity of an ecosystem. In his recent LinkedIn post, by Peter Walker at Carta, he explains that Miami, which is ranked 14th in the country in total VC capital raised, should be viewed as a leading innovation ecosystem because of its top tier rank in early-stage investment (pre-priced and priced Seed rounds). In Miami’s ecosystem, organically grown early-stage startups simply have not had enough time to mature to raise the type of rounds growth capital rounds that would put the ecosystem on par with more mature ecosystems.

Where is Georgia Today (Fall 2024)?

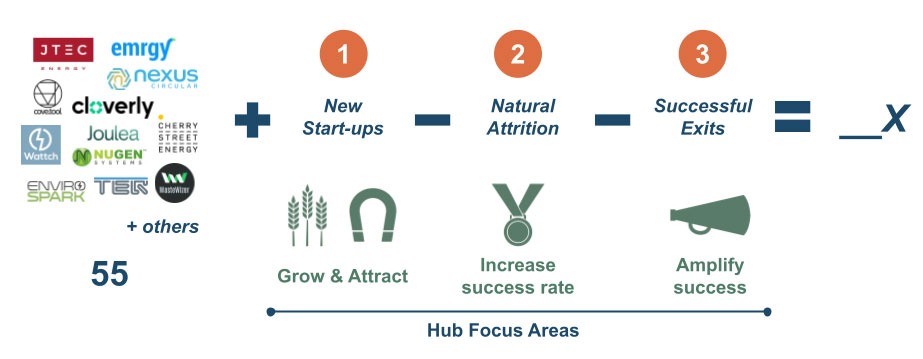

The Georgia Cleantech Innovation Hub published a living list of Georgia-based cleantech startups in September. The list includes 55 companies from around the state working on technology or business model solutions to reduce the scale and impact of carbon emissions. The list skews toward companies in the early stages of the innovation funnel, indicative of a nascent ecosystem, however, there is a cohort of companies that that have reached significant scale and influence within the ecosystem (cove.tool Cherry Street Energy, EnviroSpark Energy Solutions, Nexus Circular, Emrgy Inc. , JTEC Energy, Inc., Urjanet (exit to Arcadia)). Expect more analysis on the ecosystem’s innovation funnel to be forthcoming.

In addition, numerous programs have emerged to stock and sustain the pool of startups, e.g, Sustain-X, ATDC’s Sustainability Practice Area, the Cox Cleantech Accelerator to name just a few. What is also encouraging is that of the state’s most successful startups (see above list, measured by fundraising, >$20M), all were able to raise at least a portion of their pre-seed/seed rounds from investors in or around the state. Moreover, pure-play venture investors and corporate venture groups, like Energy Impact Partners, Anzu Partners, Shorewind Capital, Southern Company, Cox Enterprises (via Socium Ventures and Cox Cleantech), Delta Air Lines (via Sustainable Skies Lab), The Coca-Cola Company (via Greycroft Coca Cola System Sustainability Fund) Novelis, and Engage, have presence in the state.

All of these signs point to an existing, albeit developing innovation funnel, but one with momentum and components that grow it with the coordinated interventions.

What is Next?

First, it is not necessary to wait until Step 2, Create a Winning Strategy is complete to move forward; well-coordinated actions toward growing the cleantech innovation funnel will be beneficial even before a strategy is fully baked.

Second, building a pipeline of successful startups is just a math equation (Figure 2). The equation can be applied to each level of an innovation funnel, as well as to the entire funnel.

Figure 2: Innovation Funnel Stocking Math and Actions

The key takeaway from this is that there are a few macro levers that exist to grow the number of startups: 1) organic growth, 2) attraction of startups from outside the ecosystem, 3) improvement of the startup success, 4) leveraging the momentum of exits. A winning strategy will connect individual programs under these macro levers to the state’s differentiated assets so that a robust innovation pipeline is created.

There are few things that the ecosystem can do now with no regrets while the strategy is being crafted:

- Build out a more detailed view of the innovation funnel to support crafting the strategy and also taking action now.

- Help recruit the best cleantech companies to apply and join the Cox Cleantech Accelerator. Miguel Granier, Hannah Turner, Cox Enterprises, gener8tor, Georgia Cleantech Innovation Hub are putting together a program that will bring the best of Georgia to bear on these companies in hopes that they do business here.

- Amplify the success of the Georgia-based cleantech startups, especially those nearing the end of the funnel. Graduating a cleantech unicorn from the ecosystem will have a major impact for companies across the funnel.

- Begin building a community of local angel investors. The innovation funnel is rich with strong ideas and founders, and the Cox Cleantech Accelerator will only bring more leading companies to the state.

How Do We Know When We Get There?

From what we have learned is that there is no hard and fast number of startups and investment that identifies when an innovation ecosystem has reached “critical mass”. However, there are a few milestones that are worth tracking:

- First unicorn valuation or major exit of a cleantech company — While this does not speak to the health of the overall innovation funnel, it does serve as an important proof-point. The knock on impacts are also considerable, and Georgia has strong cohort approaching this stage.

- An active, coordinated cleantech angel investor community — Georgia’s strongest cleantech startups today all received a portion of their pre-seed or seed funding from local investors, full stop. If there are engaged local angels, the early funnel stages must be well stocked, and if history serves us well, these companies will be some of the most successful.

- Broad corporate engagement in innovation funnel filling initiatives — Key word is “broad”, there will always be 1 or 2 leading organizations, but the depth of the cohort of fast followers speaks to the strength of innovation pipeline (see Greentown Labs development story).

Stay tuned for the next installment around creating the places, spaces, and culture that sustain young, high growth companies. If you like this please consider following us on LinkedIn, subscribing to our newsletter, or making a donation.